After spending a few years at EASI and with a good hundred demonstrations of Adfinity behind me, I get the impression that one the features which makes accountants’ lives easier is also one of the most simple: I'm talking about spreading invoices!

Right now, I don't know one single piece of software that is able to manage this function as well as ours.

The principle is simple: you get an invoice for insurance which covers a period of 12 months. You account for this invoice in April 2015. It covers the period 04/2015 – 03/2016.

Without Adfinity, you must remember that you will pay for 9/12 of this in your current financial year, and then, next year, you must generate a journal entry with the remaining 3/12… But that is actually quite simple… If you want to get a monthly or quarterly statement, you have to monitor these invoices throughout the year… And the loss of time can be significant… Not to mention the risk of error!

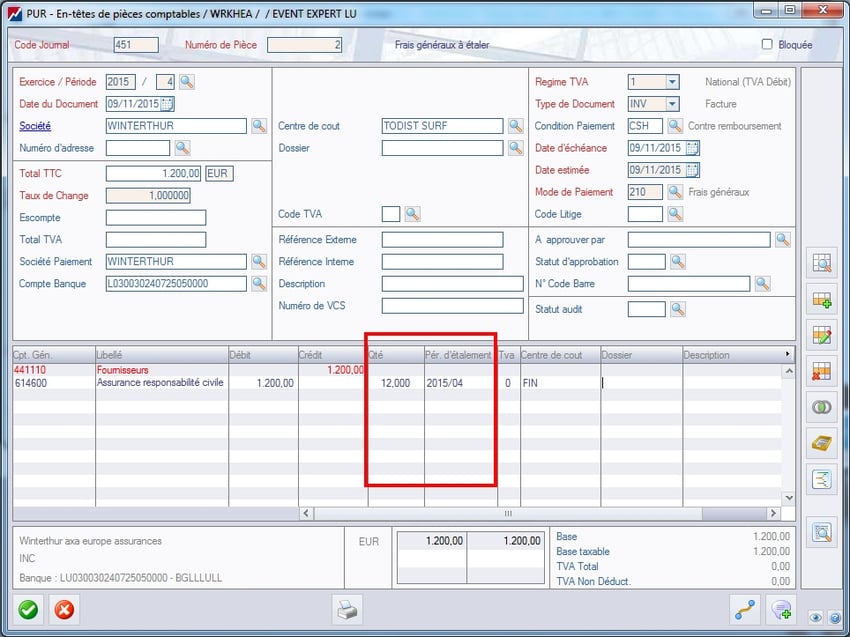

On the Adfinity entry screen, you have 2 additional columns: Quantity and Spreading period.

In our example, we indicate “12” as a quantity for the 12 months over which this invoice must be spreaded. For the staggering period, I indicate the starting period (2015/04).

When the invoice is entered, the system will ask me to automatically generate 13 journal entries! The first journal entry transfers the €1200 from the expenditure account (6) to a suspense account (49). The 12 other journal entries are the 12 parts of the invoice: each month, €100 will be transferred from the suspense account (49) to the expenditure account.

The system will therefore write the journal entries into the 2016 financial year in advance! For numbering documents, this is not an issue since Adfinity manages numbering by period!

If you fear that this situation generates too many journal entries, it is also possible to have a monthly journal entry which incorporates all of the invoices “spreaded” for the month.

A more complicated situation: you are in April 2015 and you get an invoice indicating a period covering “March 2015 to February 2016”. If your month of March is closed, the system will enter 2 months for April and then, 1/12 each month until February 2016!

This way, your monthly and quarterly statements are always correct without any effort!

And what about traceability? We have thought of everything: you can see the link to the original purchase document from each journal entry. From the document, you can find the 13 connected journal entries… for optimum monitoring!

So, who uses this feature? What do you think? Would you also find this feature to be very useful? If you don't use it, why?

Please give us your opinion!

Donnez-nous votre avis !