What is bank reconciliation?

The purpose of bank reconciliation is to account for any differences between your accounts and your bank statements.

This process is mainly carried out in the French accounting system.

Bank reconciliation involves linking (tallying) transactions that have already been recorded by the company and the bank to reveal any entries that only appear once, in other words, records only showing in the bank statements or the accounts.

The user then prints out the bank reconciliation report, which is a document whose purpose is to check that the balance established by the company matches the balance shown on the bank statement.

This means you can account for any differences between the two balances.

If you are an accountant in France, you no doubt enter your financial transactions in the form of “opérations diverses” (OD – miscellaneous transactions) before you get your bank statements. EASI has therefore added a fully integrated bank reconciliation programme in its Adfinity software.

How it works in Adfinity

A new program has been developed: WRKBNKREC

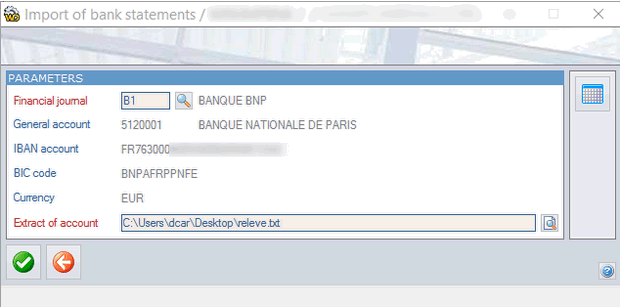

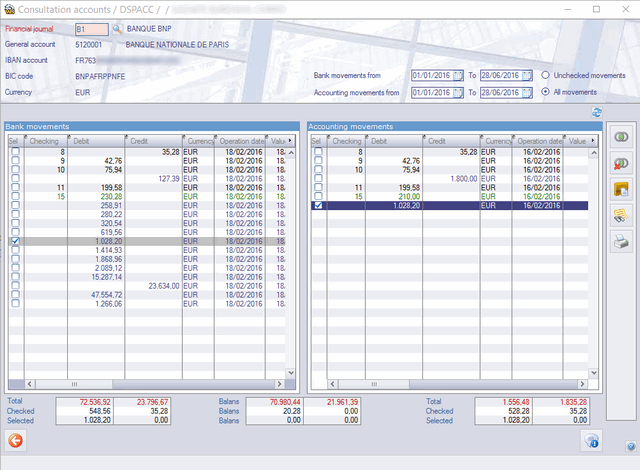

On the first screen, you can import your bank statements. On the next screen, you will see 2 tables side by side so you can complete the reconciliation:

- the first table shows “OD” transactions

- the second shows the previously imported statements

At this stage, all you have to do is select the different transactions in your bank statements and then confirm the reconciliation once the amounts match. A tally number will be generated after confirmation, so you can see at a glance the transactions associated with a particular statement.