The company car is once again in the eye of the storm when it comes to budgets and cost estimations. The last "attack" on this form of fringe benefits focuses on the deductibility of fuel costs.

Since January 1st, 2017, every company covering the fuel costs for private use of company cars has to book 40% of the benefit of all kinds resulting from the disposal of the vehicles as non-deductible expenses (NDE). This applies regardless of whether the company provides a fuel card or reimburses the actual expenses. These new non-deductible expenses should be stated in a separate field in the tax return.

Practically speaking, it is sufficient to adapt your accounting software by allocating a cost account when booking the salaries, in which you activate a "non-deductible expenses" field and this for a percentage of deductibility of 40%.

For other non-deductible expenses linked to vehicles, let us remind you of a number of rules to be respected:

- Financial interests related to expenses for the fleet are fully deductible

- In terms of fuel costs or taxi fares, 25% is considered to be non-deductible expenses

- For other costs, the CO2 emissions will determine the percentage of deductibility

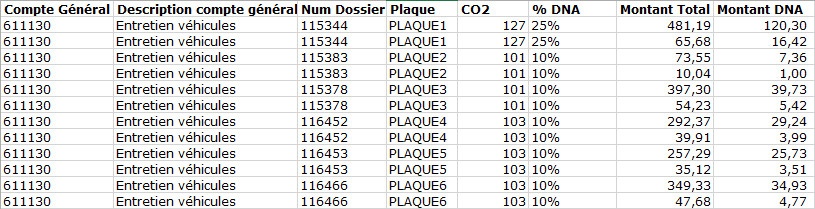

In our Adfinity accounting software, we consistently use the analytical axis "Number Plate" when booking any cost linked to company cars to manage the deductibility. The following information is therefore linked to each number plate:

- The CO2 emission

- The emission category

- The % deductibility of each car

It is also possible to define the field "Number plate" as a required field in the parameterisation of the general accounts linked to the company cars.

A simple export of these data allows to gather the necessary information that should be stated in the attachments to the tax return related with the non-deductible expenses.

Of course, you can also use other analytical axes and parameterise according to your own wishes and needs.

Do not hesitate to reach out and ask your consultant!