First and foremost, this article is the second part of our topic on finding out more about the world of accounts. You can find here a link to the first article which will no doubt help you to understand this better.

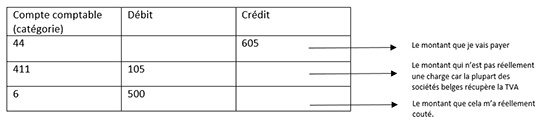

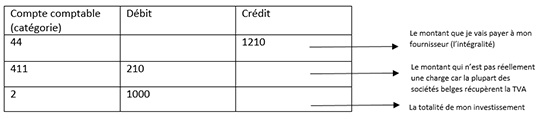

In a previous article, we analyse the various fundamentals of accounting (money IN/OUT and Expenses/Income). The purpose of this was to understand written accounting which was presented on several lines. As a reminder, a purchase invoice was presented like this:

Investments

In accounting, numerous purchases are considered to be investments. A car or a computer, and even the chair where you sit in the office.

When you purchase an "immovable" (understand by this an investment), the accounting rules allow you to depreciate the amount of the purchase over several years. If you buy a car today at €30,000 which you will use for 4 years, it would not be very correct to only affect the year 2016. Accounting rules therefore allow the assets to be depreciated over a period that is more or less long (depending on the nature of the purchase – for a building, for example, we can go to 20 years of depreciation).

The entry to reflect this type of thing will therefore be a little different from what we have seen.

We will first enter the purchase invoice for a computer for €1210.

I have therefore put all of my investment into a category 2 account.

These accounts are provided for this type of scenario, it is like a “reserve pot”.

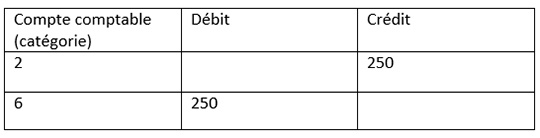

Every year, for 4 years, I'm going to take a part of this “pot” to transfer it into expenses (6), so each year, my company will take a part of the computer as an actual expense.

This is reflected by a transfer entry for the year 2016:

In 2017, 2018 and 2019, this entry will be redone in an identical manner… Some companies also make monthly rather than annual entries in order to smooth the expense “month-on-month”.

Imagine the number of entries that this could represent, knowing that most of the objects which surround you in the office are immovables. Our EASI Financial software enables all these entries to be managed automatically. Once you have entered the invoice, the system detects that this is an immovable and proposes a depreciation plan (month-on-month, if you so wish). Every month, it automatically takes care of making transfers from the depreciation accounts to the expense account for all investments!

Budgets

Now that we have seen the concept of investments, it is possible to speak about budgets! In your day-to-day work, you are perhaps forced to draw up budgets.

We have seen in the first article that there are 2 concepts: the “money in/out” concept and the “expense/income” concept. We have seen that for investments, this influences money in/out once, while for “expense/income”, the expense is divided over time.

When we speak about budget, there are also 2 concepts:

- “Money in/out” budget:

The IT manager is given a budget of €100,000 to spend over the year. - “Accounting” budget:

A decision is made as to how much expenses should be provided for the IT department.

Typically, the IT Manager is given a “money in/out” budget. This is an envelope of money to spend. Based on this budget, the financial department draws up an expense forecast.

The most simple example to illustrate all of the concepts explained in these 2 articles is as follows: The IT Manager orders a server for €35,000 excluding VAT

At accounting level, he will take out the amount of €35,000 from the company's bank accounts (a little bit more with the VAT but that will be recovered a little later).

This expenditure will eat into the IT department's budget, so the IT Manager will have around €65,000 left to spend.

On the other hand, accountingwise, the server will be put into investments (or “immovable”) and 25% of it will be charged for the year 2016. The expenses which burden the IT department will therefore be €8750!

This is thus an illustration of the great difference between "the money in the bank account" and the true profitability of the business. Many businesses are profitable (when you look at accounts 6 and 7) but have empty accounts…

This concludes this article on accounting fundamentals. Please do not hesitate to share your comments with us or give us ideas for future topics!