Accounting is a subject which is often associated “with figures”. One day or another, everyone in the company finds themselves confronted “by the accounts department”… Many of our readers are not accountants, therefore I have decided to prove to you how far accounting influences our daily lives. I am also going to explain in a simple manner that, beyond the savage terms that they use (and which are also used in many articles in this blog), it is mainly to do with common sense and thoroughness!

I personally discovered accounting when I started to work at EASI… I very quickly realised that without knowing it I had already done accounting – in daily life... We are going to try in this article to make parallels with life and thus decipher the codes from this mysterious world!

If I had to explain the broad lines of accounting, I would say that it is a matter of clearly recording all my company's transactions. I would say that there are 2 aspects to take into account:

1. The “Money IN/OUT” aspect

In brief, what I owe to others (debt) and what others owe to me (receivables).

For example, in daily life:

- a. I have to pay my electricity, gas and telephone bills (pay my debts)

- b. I have my employer who owes me my salary, and a friend who must repay me some money (accept receivables)

In accounting, we will therefore enter one line per transaction.

We will give each line a “category” (debt or receivable), in order to know if this is money that we owe or that we are going to receive.

These “categories” are in fact collected within a chart of accounts (categories list). This is a list of accounts to be used under different circumstances.

To make it simple, the government dictates the accounting rules and says that companies must:

- put debts into a category called “44” (gas/water bills, rent, etc.)

- put receivables into a category called “40” (salary that I'm expecting, money lent to a friend, etc.)

These accounts are called centralisers in accounting.

2. The “P&L” aspect (which means “Profit and Loss”)

Beyond knowing what I am owed and what I owe, it is essential to know the profitability of your business. For example, when a client pays me an invoice of €121, I only earn €100, since €21 must be allocated to VAT.

As for debts and receivables, a category must be determined for each “transaction”: expense (6) or income (7)

In reality, there are different subcategories for these accounts depending on the nature of the purchase or the sale (cost of goods, cost of vehicles, etc.)

3. Practical examples

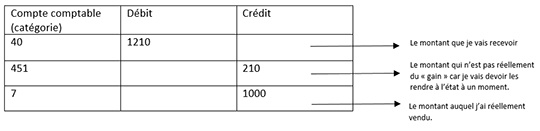

Now that we have seen these 2 important concepts, here is how to enter the simple invoice into the accounts:

Case 1: I sell office supplies. I issue my client with an invoice for €1210.

I will start therefore by entering several pieces of essential information into my accounting software, such as: the invoice date, the supplier, the external reference, etc.

Then several lines will be entered:

Case 2: Before selling the supplies, I had to purchase them from my wholesaler to feed my stock.

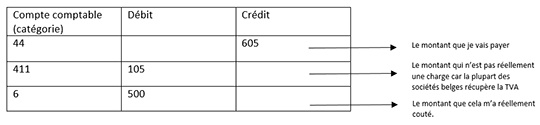

I therefore received at that time an invoice for €605. I entered it as follows:

If we analyse our accounts following this and based on what we have entered:

- I owe €605 to my supplier (44)

- I owe €210 to VAT (451)

- I shall receive €105 into VAT (411)

- I shall receive €1210 from my client (40)

- I had and expense of 500 and income of 1000, so my profit is therefore €500.

In this simple case, we realise that if we didn't use accounting, but just our bank account, we would not be able to be aware of the actual situation of our business.

At the end of the year, I made the sum of €500 on this sale.

Although, on my account, other sums will be displayed perhaps for a few months which will not reflect my accounting.

Now that we have laid the foundations, in the second part of the article we will see more advanced concepts which affect all departments: analytical accounting, budgets, investments, etc.

See you next Tuesday!